The Man vs. The Market: How "The Big Short" Shocked the Financial World

The movie The Big Short shows how hedge fund experts made huge profits by predicting the housing market collapse and short-selling the market (in other words, betting on market declines).

One day, in 2006, hedge fund manager Michael Burry noticed an increase in delinquency and default rates on real estate loans. He then started an all-out investigation into the then-current state of mortgage loans (equity-secured loans) that made up each real estate bond.

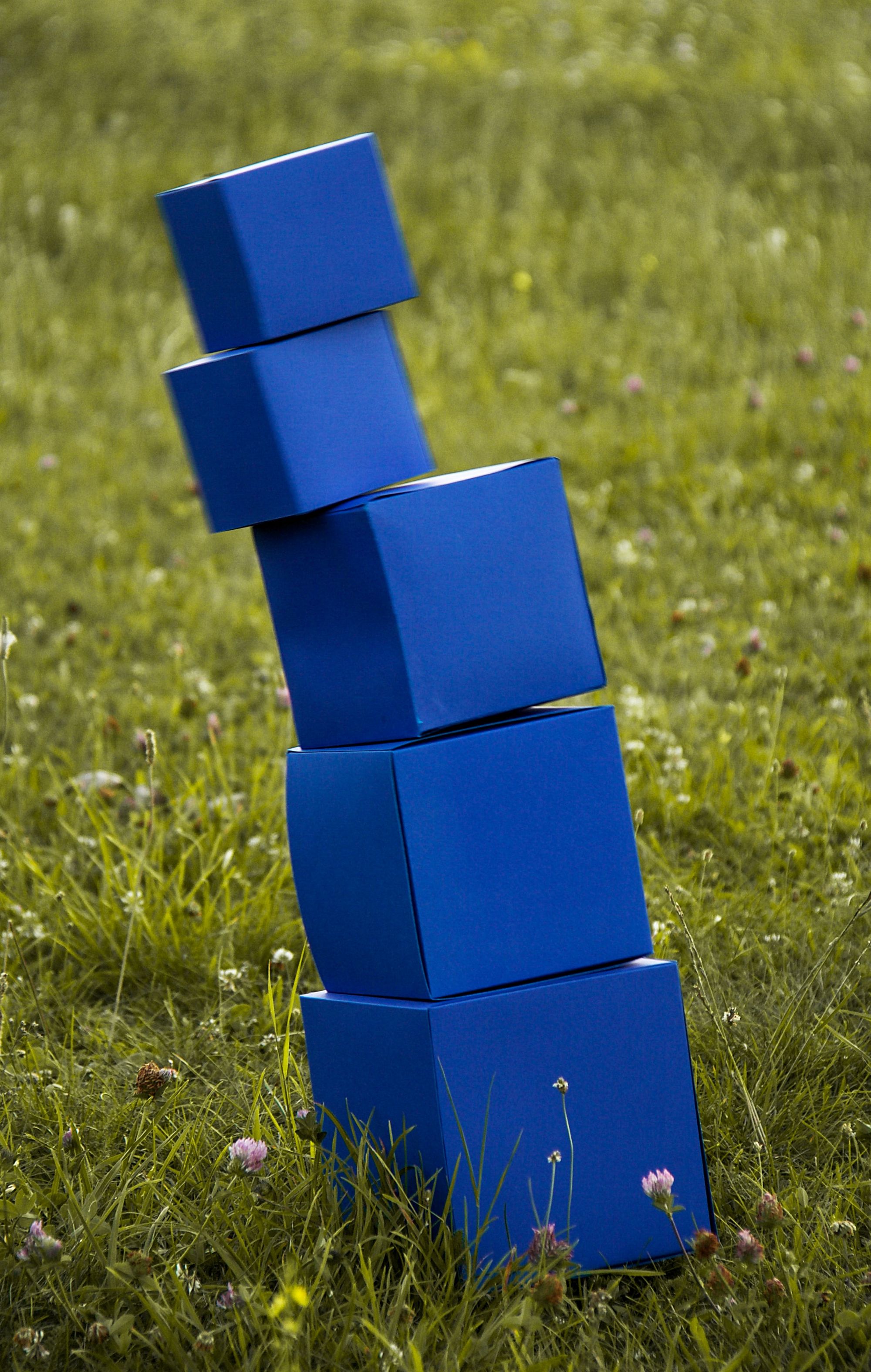

By analyzing numbers and data, he found that the real estate market was being propped up by a pile of volatile bad loans, like an unstable Jenga tower. Burry immediately visited renowned investment banks such as Goldman Sachs and Deutsche Bank and asked them to create non-existent derivatives and default swaps for mortgage bonds. In short, it was like an insurance product that could make money if the real estate market collapsed.

Believing that the real estate market was stable, global investment bank officials ridiculed Burry for making heavy downturn-based speculations. Eventually, they sold him the credit default swaps he asked for, saying that they'll take "the free money he was offering them" and collect massive sales commissions in the process.

The news quickly spread across Wall Street. Burry's short-selling investment and real estate market outlook report caught the attention of a few.

Mark Baum, who was the head of a hedge fund company decided to check if the bubble in the real estate market was true. He instructed his employees to visit residential areas to conduct due diligence on the real estate market. Everywhere they went, his team found vacant homes, homes under construction, and homes for sale. Baum also pretended to buy a house and was introduced to a mortgage broker who told him that most clients were low-income immigrants who did not speak English or people who worked in entertainment establishments that had no proof of income.

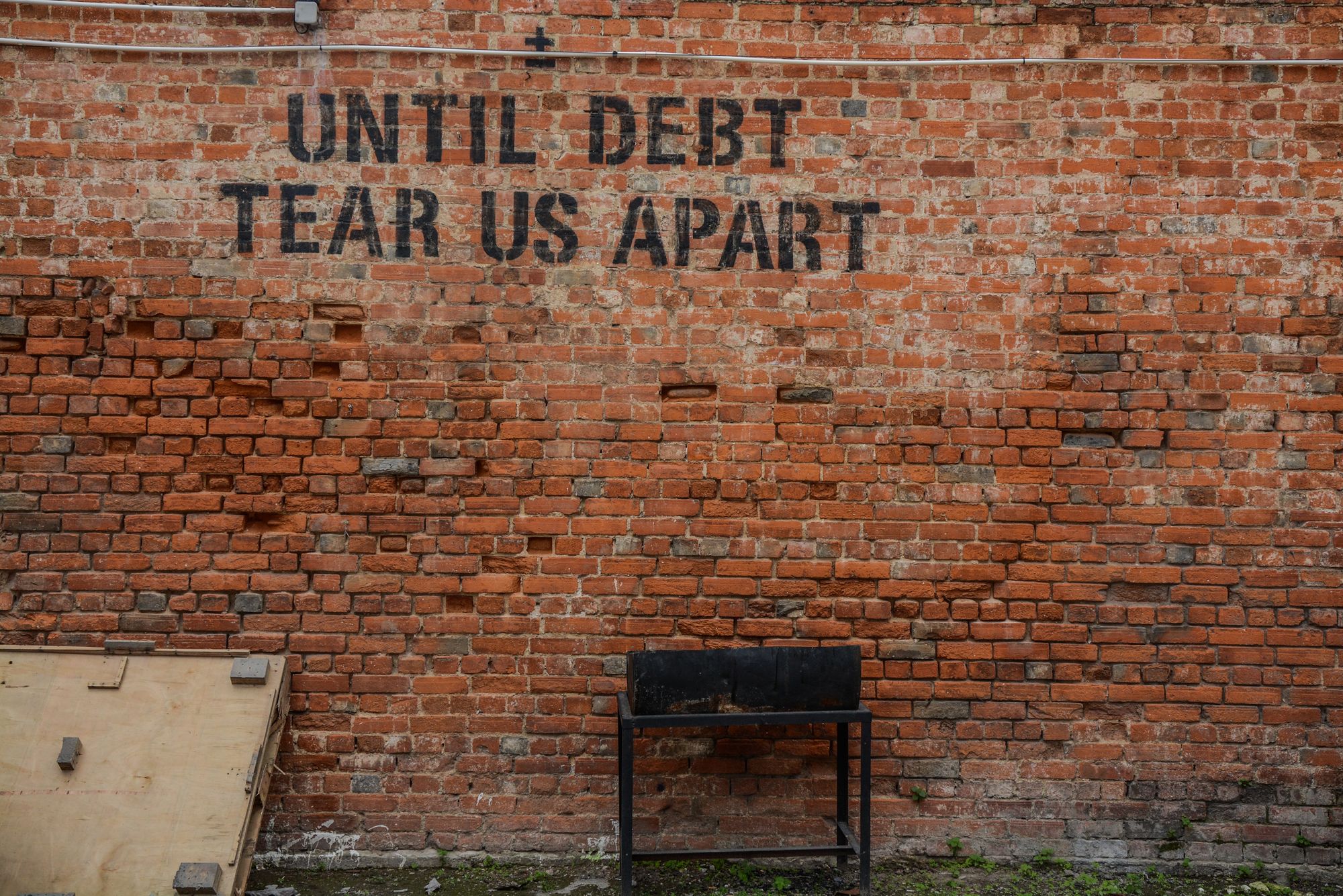

The bank lent to these people because of high brokerage fees. For people with low credit ratings or variable rate loans, fees could soar up to five times the average price. Banks and brokers sold these risky loans, earning huge profits from commissions and gradually weakening the real estate market that would soon collapse.

Through his process of due diligence, Mark Baum arrived at a similar conclusion to Michael Burry; he predicted that the real estate market would collapse due to loopholes in the financial system, the negligence of the Financial Supervisory Service, and the greed of the financial world.

Two years later, in 2008, the subprime mortgage crisis began with the bankruptcy of financial services firm Lehman Brothers. As financial markets started to crumble, countless people lost their jobs, and the severance pay and pensions they had invested in over the course of their lives disappeared overnight.

It's easy to fall back on the notion that our financial system is stable and that the decision to invest in what most people are investing in is likely to be correct. However, Michael Burry used numbers and data to capture a future financial crisis that others had not seen. Despite the fact that he was an unknown investor going against the opinions of most established financial professionals, Burry's clear analysis led others like Baum to make their own respective investment decisions through due diligence and research.

Before deciding based on blind faith in the system and advice from famous financial advisors, you need to make investment decisions with data and due diligence. By taking the time to learn how to read the market, obtain relevant information, and trust your investment sense, you can also make the best, most informed investment decisions for yourself.