Trust, Timing, and Texas: A Roadmap for Biotech Entry into the U.S.

Interview with Jung Young-ho, Consul General of the Republic of Korea in Houston

Author of “We Go to Texas” and “I Am Texas’ First Salesman”

To gain a strategic perspective on how Korean biotech companies can successfully enter the U.S. market, we spoke directly with the diplomatic leader who pioneered access to Texas.

He has not only envisioned—but actively designed—a once-invisible path for global expansion. In this interview, we explore his actionable strategies and sharp insights from the front lines.

“This is my first time meeting a Korean Consul General.”

Those were the opening words of William McKeon, President of Texas Medical Center (TMC), when I met him shortly after arriving in Houston as Consul General of the Republic of Korea.

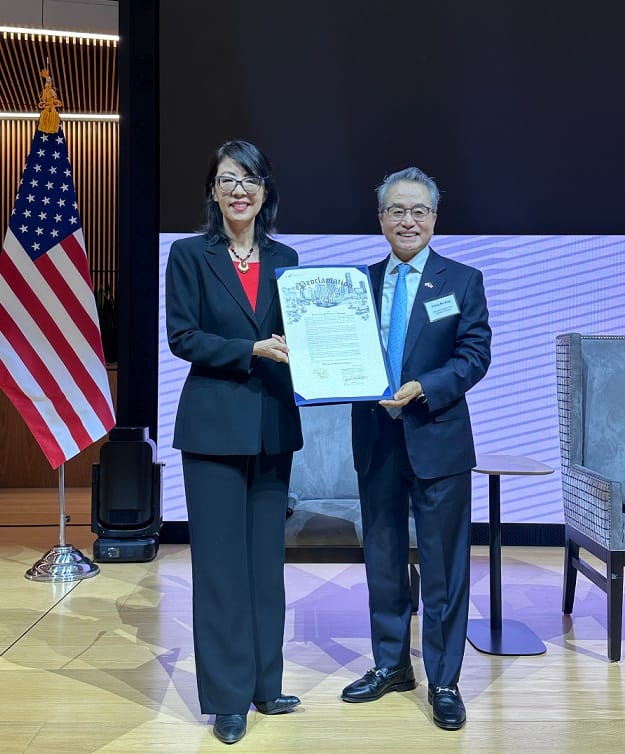

That meeting sparked a new dialogue between Korea’s biotech sector and the largest medical cluster in the U.S. Within months, top institutions like MD Anderson and Houston Methodist began engaging directly, culminating in the Korea–U.S. Bio Forum in June 2024. On that day, the Mayor of Houston declared “Korea–U.S. Bio Day”—a symbolic yet strategic milestone.

As Boston and San Francisco grow crowded and costly, Texas is emerging as the next biotech frontier. But entering the U.S. market takes more than innovation—it requires trust, clarity, and strategic alignment.

This article offers a clear and timely roadmap—for Korean biotech companies and global innovators alike—on why Texas matters now, and how Houston can serve as a launchpad for meaningful global growth.

Q1. Why should global biotech companies focus on Texas—right now?

“In the U.S. biotech industry, Houston is emerging as the third major power center.”

That’s what Texas Governor Greg Abbott declared at the opening of TMC Helix Park in November 2023. It wasn’t just a statement about one city—it signaled the rise of a new Bio Triangle: Boston–San Francisco–Houston.

While Boston and San Francisco remain dominant, they are increasingly saturated, high-cost, and competitive. Houston, by contrast, offers a fast-expanding ecosystem, anchored by the Texas Medical Center (TMC)—the world’s largest integrated life sciences hub—and backed by robust federal and private investments under the U.S. national bioeconomy strategy.

As a diplomat working at the intersection of policy, innovation, and international collaboration, I’ve witnessed firsthand how Texas is lowering barriers for global biotech players—particularly those seeking early-market access, clinical infrastructure, and scalable partnerships.

Now is a pivotal moment. For companies across Asia, Europe, and beyond, Texas is no longer a secondary option—it’s a strategic first move into the next chapter of American biotech innovation.

Q2. Where is the epicenter of biotech collaboration in Texas?—and why does it matter globally?

The answer is clear: Texas Medical Center (TMC).

As the world’s largest life sciences complex, TMC houses over 60 leading hospitals and research institutions, including MD Anderson, Houston Methodist, and Texas Children’s Hospital. It ranks second in the U.S. for cumulative clinical trials—but more importantly, it offers something few other places can: a fully integrated, end-to-end biotech ecosystem.

From early-stage R&D to clinical trials, FDA approval strategy, and commercialization, TMC isn’t just a cluster—it’s a platform. With new innovation districts like Helix Park and the TMC Innovation Factory now in full swing, TMC is where science, capital, and business infrastructure converge in real time.

During my tenure as Consul General in Houston, I met global executives who were initially familiar only with MD Anderson. But after experiencing the broader TMC ecosystem, they consistently told me: “We had no idea this level of integration existed.”

This is what sets TMC apart—not just its scale, but its strategic coherence.

Whether you’re a Korean biotech firm or a global startup seeking a U.S. foothold, TMC offers one of the most globally connected gateways to launch, collaborate, and scale in the American biotech landscape.

Q3. What makes Texas a compelling alternative to traditional U.S. biotech hubs?

While Boston and San Francisco remain global leaders in biotech, they come with high barriers: soaring operational costs, intense competition, and limited room for newcomers. Even established international companies often find it difficult to gain traction in these saturated markets.

That’s why Texas—particularly Houston—is emerging as a strategic alternative.

With its business-friendly tax policies, lower cost base, and rapidly expanding life sciences infrastructure, Texas offers a more accessible and collaborative pathway.

During my tenure as Consul General in Houston, I observed firsthand how companies that adopt an incubator-style entry model—pairing agile startups with resource-rich mid-size partners—are able to scale more effectively.

In this model, startups contribute innovation and speed, while larger firms offer structure and capital. Together, they can activate opportunities through TMC’s vast network of labs, clinical trials, and venture accelerators.

For global biotech players seeking not just entry—but traction—in the U.S., Texas represents a chance to build strategic bridges rather than compete alone.

Q4. Are there real-world examples of Korean companies engaging with Houston’s biotech ecosystem?

Yes—and these early cases offer meaningful insights for global firms exploring U.S. entry strategies.

In November 2023, Boryung, a leading Korean pharmaceutical company, visited Houston to explore investment in space medicine, aligned with its role on the board of U.S.-based Axiom Space. During my tenure as Consul General, I personally facilitated their connection to the NASA network and arranged visits to the TMC Innovation Factory and JLABS @ TMC—Johnson & Johnson’s flagship life sciences incubator. Boryung later conveyed a clear message: “We are determined to be part of this ecosystem.”

CJ Group also took strategic steps. As part of its growing biotech investment portfolio, CJ America and executives from Seoul National University Hospital visited Houston as sponsors of the Korea–U.S. Bio Forum. Initially focused on MD Anderson Cancer Center, they came away with a deeper understanding of TMC’s full-scale, integrated infrastructure—and expressed strong interest in future collaboration.

Although TMC remains under-recognized in Korea, every Korean company that has experienced it firsthand walks away with the same conclusion: “We need to be here.”

As someone who has witnessed these early bridges being built, I remain committed to expanding this platform—so that interest can evolve into durable, strategic partnerships between Korean innovators and Houston’s growing biotech ecosystem.

Q5. Is there a trusted expert network in Texas to support FDA approval strategy?

Absolutely—and this resource can be a game-changer for companies seeking entry into the U.S. market.

Understanding that FDA approval remains one of the most complex and costly hurdles for global biotech firms, I invited Lachman Consultants, a leading regulatory advisory firm, to participate in the Korea–U.S. Bio Forum. Headquartered in New York, Lachman has decades of experience guiding pharmaceutical and biotech companies across North America and Europe in FDA strategy, regulatory compliance, and quality system development.

During the roundtable I organized, their team provided an in-depth briefing on the FDA’s structure, approval phases, and tactical insights—from pre-IND to NDA submission. The feedback was immediate and clear: “This is the first time we’ve seen the FDA process explained so clearly, end-to-end.”

For many international companies—including those from Korea—developing a robust FDA strategy independently is daunting. That’s why access to seasoned regulatory networks like Lachman is not just helpful, but essential. These connections dramatically lower the barriers to entry, while improving the probability of success in one of the world’s most competitive biotech markets.

For any company serious about long-term U.S. growth, regulatory navigation cannot be improvised—it must be engineered. Fortunately, Texas is building the right partnerships to make that possible.

Q6. Does Texas provide an end-to-end infrastructure for FDA-focused biotech development?

Yes—and not only in theory, but in practice. At the center of this capability is the Texas Medical Center (TMC), the largest integrated medical and life sciences campus in the world. Within TMC lies JLABS @ TMC, the flagship biotech incubator launched by Johnson & Johnson in 2016, where early-stage innovation meets late-stage execution.

Here, companies can move through the entire product development cycle in one place: from early research and prototyping to clinical design and FDA regulatory preparation. This continuum is further reinforced by world-class hospital networks like MD Anderson and Houston Methodist, and by direct access to regulatory advisors such as Lachman Consultants—creating a realistic, connected pathway from lab bench to market approval.

Texas may not yet rival Boston or San Francisco in terms of ecosystem maturity—but its cost-efficiency, regulatory agility, and growing collaborative infrastructure offer compelling advantages, especially for international entrants seeking speed and structure.

For companies serious about FDA approval, Texas isn’t just emerging—it’s operational. And for early movers, that makes this window especially strategic.

Q7. Can Texas serve as a viable launchpad for bio-functional cosmetics?

Absolutely. Texas is not only a gateway for biotech—it’s also an emerging frontier for bio-functional cosmetics grounded in scientific formulation and clinical efficacy.

In a recent meeting with the head of CJ America, I suggested a forward-looking strategy: “Rather than simply importing products, why not manufacture bio-cosmetics locally in Texas—under a ‘Made in USA’ label—with credibility aligned to FDA-level standards?”

This vision rests on three core pillars:

1. Establishing local production capacity

2. Securing functional certification aligned with U.S. regulatory benchmarks

3. Adapting product positioning to North American consumer behavior

With major K-beauty players like CJ and Olive Young actively expanding across North America, the opportunity lies in going beyond trend-driven exports toward evidence-based innovation. I’ve facilitated connections between these companies and the TMC innovation ecosystem, including access to FDA advisory networks, so their products can meet biomedical-grade expectations.

The result? A new category of beauty products—where cosmetic meets clinical.

For Korean and global bio-beauty firms alike, Texas—especially Houston and the TMC corridor—offers a cost-efficient, medically aligned platform to test, certify, and launch next-generation products into the U.S. market.

Q8. What should international biotech companies—especially from Asia—consider for successful entry into Texas?

Texas is widely recognized as one of the most business-friendly environments in the U.S., with flexible regulations, no state income tax, and pro-enterprise policies. But for global biotech companies—particularly those from Asia—navigating the local landscape still requires strategic foresight and cultural fluency.

Here are three areas to approach with care:

1. Environmental Compliance While Texas maintains more relaxed state-level environmental rules compared to other states, federal EPA standards remain strict—especially in biotech manufacturing. This includes handling chemical waste, emissions, and site safety. Early legal and environmental consultations are crucial to avoid compliance issues or costly delays.

2. Tax Structure & Incentives Texas levies no state income tax, but other taxes—like property, franchise, and sales taxes—can add up. Companies should work with local legal and financial experts to maximize available incentives, such as R&D tax credits, capital investment exemptions, or federal grant access. A tailored tax strategy can significantly improve the cost-efficiency of U.S. operations.

3. Talent & Organizational Culture Texas offers access to a diverse, highly educated life sciences workforce, especially in biotech-heavy cities like Houston, Austin, and Dallas. But retaining top talent goes beyond compensation—it also requires inclusive workplace culture, performance-driven incentives, and alignment with local HR norms. Directly replicating hierarchical or centralized models from abroad may limit long-term success. Hybrid approaches that combine global structure with local agility often yield better results.

In essence: Texas may offer the runway, but companies must still chart the right flight path. From regulatory clarity to cultural integration, success in the Lone Star biotech ecosystem comes not from speed—but from strategic alignment.

Conclusion

Texas is no longer just a center of medicine—it is fast becoming a next-generation biotech powerhouse, anchored by institutions like TMC, JLABS, Helix Park, and robust FDA-focused infrastructure.

For companies seeking to enter the U.S. market with speed, credibility, and long-term vision, Texas offers a rare combination: lower entry barriers, world-class clinical and regulatory support, and a collaborative innovation culture.

This is more than a trend—it’s a strategic inflection point.

Early movers—especially those with cross-border agility and scientific depth—have a unique chance to shape the ecosystem as it grows.

The window is open. Now is the time to build, partner, and lead.

Here are the key insights I gained from this interview.

The U.S. has long been the top priority for biotech and medical device startups eyeing global expansion.

Yet the biggest challenge has always been knowing where to begin.

Now, with doors opening in Houston, Texas, the path forward is becoming clearer—and more accessible—for startups worldwide.

There’s no such thing as a perfect environment for going global.

But when a new market starts to open, that’s when opportunity is born.

Those who move quickly—companies and individuals alike—will be the ones to lead.